us exit tax form

Your average net income tax liability from the past five years is over a set amount 171000 for 2020 You fail to indicate on Form 8854 that youve filed a tax return for each of the past five years. The decision to become a US tax resident or to leave the US tax system is not one that should be taken lightly.

Exit Tax For Renouncing U S Citizenship Or Green Card H R Block

Yes even if you are not a covered expatriate under the Exit Tax tests and dont owe any Exit Tax you must file Form 8854.

. Exit tax is calculated using the form 8854 which is the expatriation statement that is attached on your final dual status return. The US imposes an Exit Tax when you renounce your citizenship if you meet certain criteria. Net capital gain after an exemption from the deemed sale is taxed immediately.

As provided by the IRS. 3 IRC 877A Tax Responsibilities at Expatriation US Exit Tax 4 Form 8854 Initial and Annual Expatriation Statement 5 Get Your US Exit Tax Ducks in a Row First. The most important aspect of determining a potential exit tax if the person is a covered expatriate.

Citizen who relinquishes his or her citizenship and 2 any long - term resident of the United States who ceases to be a lawful permanent resident of the United States Sec. Green Card Exit Tax 8 Years Tax Implications at Surrender. The Form 8854 is required for US citizens as part of the filings to end their US tax residency.

Tax may be potentially avoided by limiting income and net worth through gifts. The defining feature is that assets are treated as if they are sold on the day before citizenship or resident status is terminated. Theyve failed to certify on Form 8854 that.

Became at birth a citizen of the US. This tax is based on the inherent gain in dollar terms on ALL YOUR ASSETS including your home. Exit tax is the IRSs last chance to tax you and is essentially taxed as if you were to sell all your assets on the last day of living in the US.

Currently net capital gains can be taxed as high as 238 including the net. Under the substantial presence test of IRC. The taxpayer who transfers his tax.

In 2017 that threshold was 162000 per year. Citizen renounces citizenship and relinquishes their US. Tax liability another way to trigger the tax is to have a high net income during the five years leading up to losing your status.

Anytime a US citizen or long-term permanent resident chooses to leave the US taxation system they must be aware of the tax consequences of doing so especially in light of the US exit tax that was brought into effect in 2008 under the HEART Act. The idea of the exit tax is the concept that if a US person falls into one of the two categories of being a Long-Term Resident or US Citizen and 1 they have assets that have accrued in value andor 2 they have amassed certain deferred income or tax-deferred investments then when its time for this person to leave the United States the IRS wants their fair share of that. Status they are subject to the expatriation and exit tax rulesBut the rules are not limited to.

The percentage of exit tax is different for everyone as it is based on your marginal tax rates. The Basics of Expatriation Tax Planning. And another country and as of the expatriation date contin-ues to be a citizen of such other country and taxed as a resident of such country.

2 IRC 877 Expatriation to Avoid Tax. If you have transferred your tax domicile outside of France after January 1 2019 then you will have the opportunity to benefit from certain arrangements without retroactive effect for taxpayers who transferred their tax domicile prior to this date Article 112 of the 2019 Finance Law. It is also required for long-term permanent residents who held their green card in at least 8 of the last 15 years.

Relinquishing a Green Card. Under Internal Revenue Code IRC sections 877 and 877A the US exit tax applies to US citizens or green card holders who are deemed covered expatriates see below when they renounce their citizenship or permanently leave the US for federal tax purposes. The US exit tax which was signed into law by President George W.

Citizenship or long-term residency triggers both the exit tax and the inheritance tax. Legal Permanent Residents is complex. The Exit Tax is computed as if you sold all your assets on the day before you expatriated and had to report the gain.

Last weeks Taxation 101 Where To Live Tax-Free essay was well received but raised lots of questions from American readers including many to do with what Id say is maybe the most misunderstood US. Generally if you have a net worth in excess of 2 million the exit tax will apply to you. The general proposition is that when a US.

By contacting a tax accountant they can estimate the. Citizenship or terminated their long-term resident status for tax purposes on or before June 3 2004 must file a Form 8854 Initial and Annual Expatriation Information Statement and its Instructions. Bush in 2008 as part of the Heroes Earnings Assistance and Relief Tax HEART Act is a burdensome financial obstacle to US citizens and long-term permanent residents who plan to expatriate from the US for federal tax purposes.

The EXIT TAX form. NEW YORK July 12 2022--Payoneer NASDAQ. Would not have been considered a resident of the US.

You will also be taxed on all your deferred compensation. Exit Tax and Expatriation involve certain key issues. Presuming the person who expatriates qualifies as a covered expatriate they will have to conduct an exit tax analysis using Form 8854.

This is per person so theoretically both you and your spouse could each be worth 19 million and still avoid the exit tax. US Exit Tax IRS Requirements. PAYO the commerce technology company powering payments and growth for the new global economy announced today the expansion of its tax services with.

THE UNITED STATES EXIT TAX 5 a. The IRS Green Card Exit Tax 8 Years rules involving US. Tax on individualsthe Exit Tax Americans have to pay when they give up their US.

The current form of exit tax deems sold all assets held worldwide by the expatriate. In order to be considered a US expatriate you have to voluntarily renounce your Green Card using form I407 and stating that you no longer wish to live in the United States. 1 US Exit Tax.

This determines the gain on your assets as well as the taxable amount of this above the threshold. The exit tax rules impose an income tax on someone who has made his or her exit from the US. Citizens and long-term residents must carefully plan for any proposed expatriation from the US.

IRS tax rules for expatriation from the United States requires a complicated tax analysis to determine if the expatriate must pay US. To clarify this is not a separate or an additional tax. 877A g 2A long - term resident is an individual who is a lawful permanent resident ie a green card holder of the United.

How to calculate exit tax. The term expatriate means 1 any US. To comply with the notification obligations under IRC 877 individuals who renounced their US.

In 2008 the first US exit tax was introduced under the Heroes Earnings Assistance and Relief Tax HEART Act. Net worth one common way that people get hit with the green card exit tax is by having a net worth exceeding 2 million at the time that you lose your status. Green Card Exit Tax 8 Years.

25 6 1 Statute Of Limitations Processes And Procedures Internal Revenue Service

Exit Tax Us After Renouncing Citizenship Americans Overseas

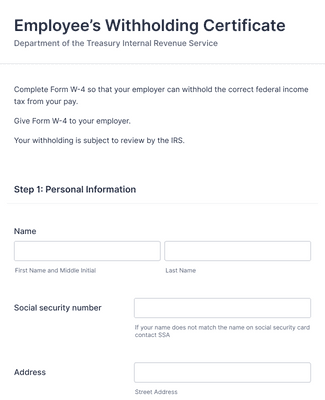

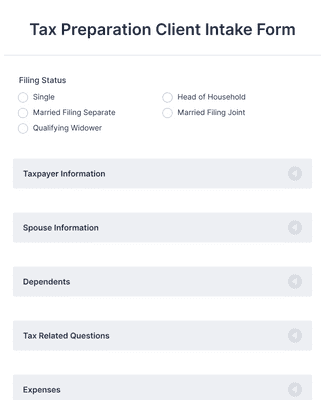

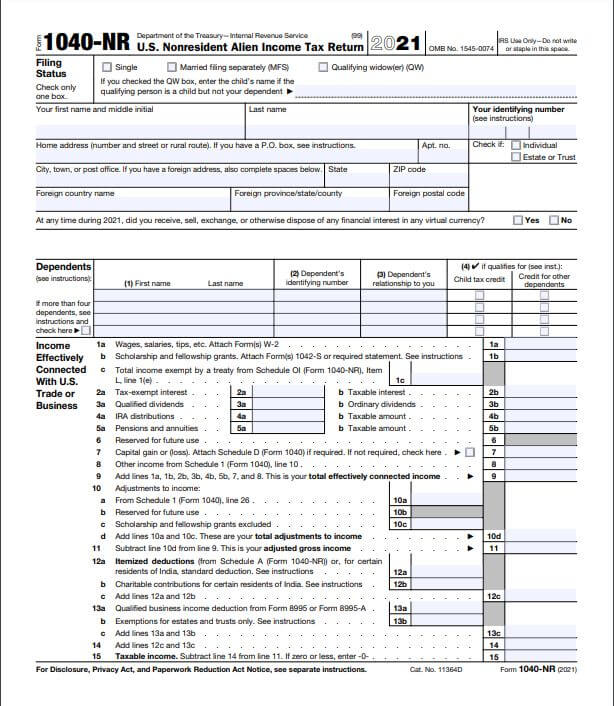

1040 Vs 1040nr Vs 1040nr Ez Which Form To File 2022

Exit Tax Us After Renouncing Citizenship Americans Overseas

Tas Tax Tip 2021 Federal Individual Tax Return Due Dates Extensions

Exit Tax Us After Renouncing Citizenship Americans Overseas

True Or False You Can Fill Out Your Fafsa Before Filing Taxes U S Department Of Education

/Form1099-INT2022-5e04b7fa54e54d2789d24757e86b1bff.jpg)

Form 1099 Int Interest Income Definition

What Is Expatriation Definition Tax Implications Of Expatriation

Exit Tax In The Us Everything You Need To Know If You Re Moving

Instructions For Form 1040 Nr 2021 Internal Revenue Service

Form Recognizer W 2 Prebuilt Model Azure Applied Ai Services Microsoft Docs

Beware Exit Tax Usa Giving Up Your Green Card Or Us Citizenship Can Be Costly